C155C Chronicles

Exploring the latest trends and insights.

Cruise Your Premiums Down with These Auto Insurance Discounts

Unlock hidden savings! Discover auto insurance discounts that can drive your premiums down and put money back in your pocket.

Unlocking Savings: Top Auto Insurance Discounts You Might Be Missing

Auto insurance can be a significant expense for many drivers, but you might be entitled to various discounts that can help you save money. Understanding these auto insurance discounts is essential for maximizing your policy's value. Some common discounts include:

- Multi-Policy Discount: Bundling your auto insurance with other policies, like home or renters insurance.

- Safe Driver Discount: Maintaining a clean driving record without any accidents or traffic violations.

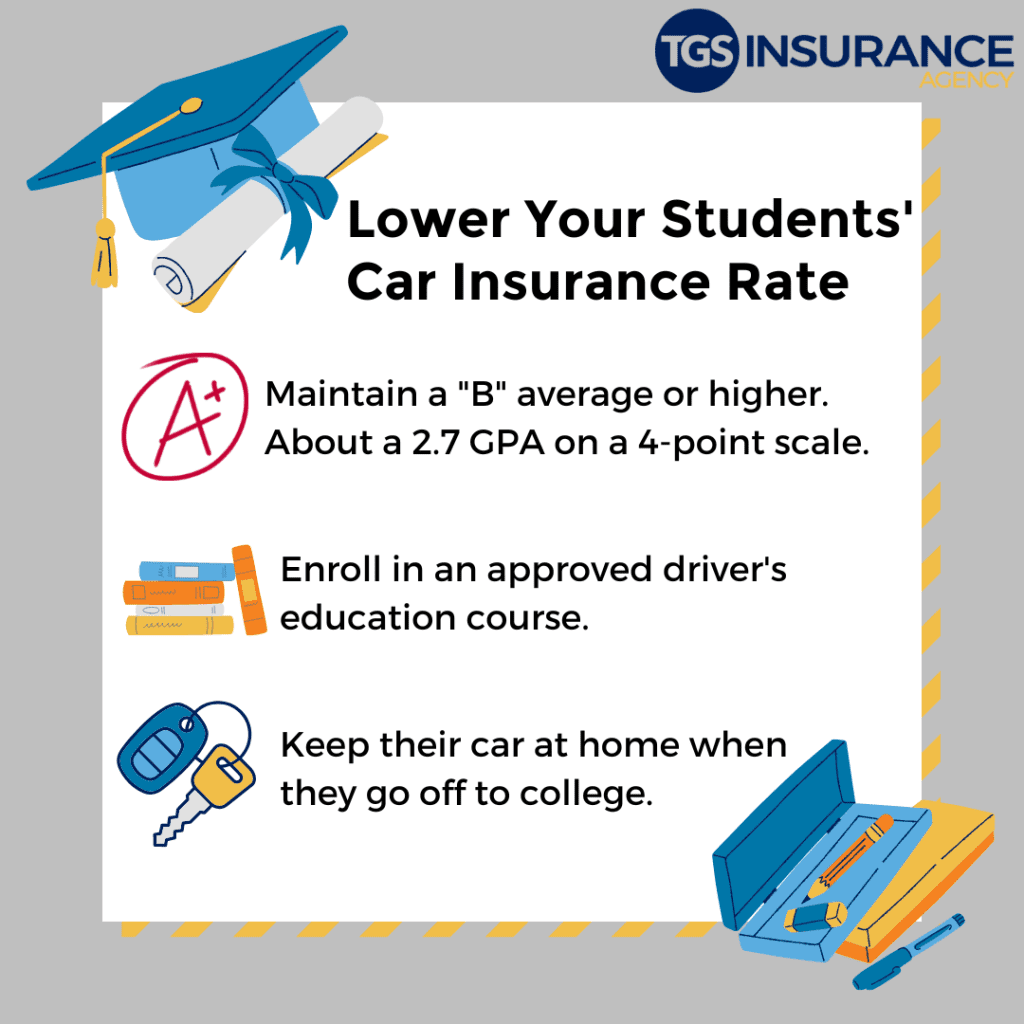

- Good Student Discount: Students maintaining a high GPA or achieving academic excellence.

Additionally, many insurers offer discounts for specific circumstances that you might not be aware of. For example, you could qualify for a low Mileage Discount if you drive less than a certain number of miles annually. Other potential savings include vehicle safety feature discounts, which reward drivers for having modern safety technologies in their cars. Don't forget to ask about payment plan discounts if you choose to pay your premium in full or opt for automatic payments. By proactively exploring these options, you can unlock substantial savings on your auto insurance.

Are You Eligible? Discover Common Auto Insurance Discounts

Are you eligible for auto insurance discounts? Many drivers are unaware that they could significantly reduce their premiums simply by taking advantage of available discounts. Insurance companies often provide various incentives to encourage safe driving, customer loyalty, and bundling of policies. Common discounts include safe driver discounts, multi-policy discounts for bundling your auto insurance with home or renters insurance, and discounts for students or members of certain organizations. It's essential to inquire with your insurance provider to see which discounts you might qualify for!

Additionally, don't overlook niche discounts such as those for low mileage, car safety features, and good credit history. Some insurers offer discounts based on your driving habits, thanks to telematics devices that monitor your driving patterns. By understanding these options, you can maximize your savings and ensure that you are fully benefiting from your auto insurance policy. Remember, even the smallest of discounts can lead to substantial savings over time, so always ask about how you can make your insurance more affordable.

How to Maximize Your Auto Insurance Savings: A Guide to Discounts

Maximizing your auto insurance savings begins with understanding the various discounts that insurers offer. Many people are unaware that they might qualify for several types of discounts that could significantly lower their premiums. Start by asking your insurance provider about multi-policy discounts, which reward you for bundling auto insurance with other types of insurance like home or renters insurance. Additionally, consider safe driver discounts if you have a clean driving record, as insurers typically offer these to reward responsible driving behaviors.

Another effective way to ensure you get the most out of your auto insurance savings is by maintaining a good credit score. Many insurance companies use your credit information to determine rates, and a higher score can lead to lower premiums. Moreover, take advantage of discounts offered for vehicle safety features such as anti-lock brakes or built-in alarms, as these can also contribute to savings. Lastly, consider reviewing your policy regularly to ensure you are not paying for coverage you no longer need, as life changes can affect the best coverage options for your circumstances.