C155C Chronicles

Exploring the latest trends and insights.

Trade Reversal Timeline CS2: When the Tables Turn

Discover the pivotal moments in CS2 trading where fortunes shift. Uncover strategies that turn the tide and maximize your game!

Understanding Trade Reversal: Key Indicators and Strategies

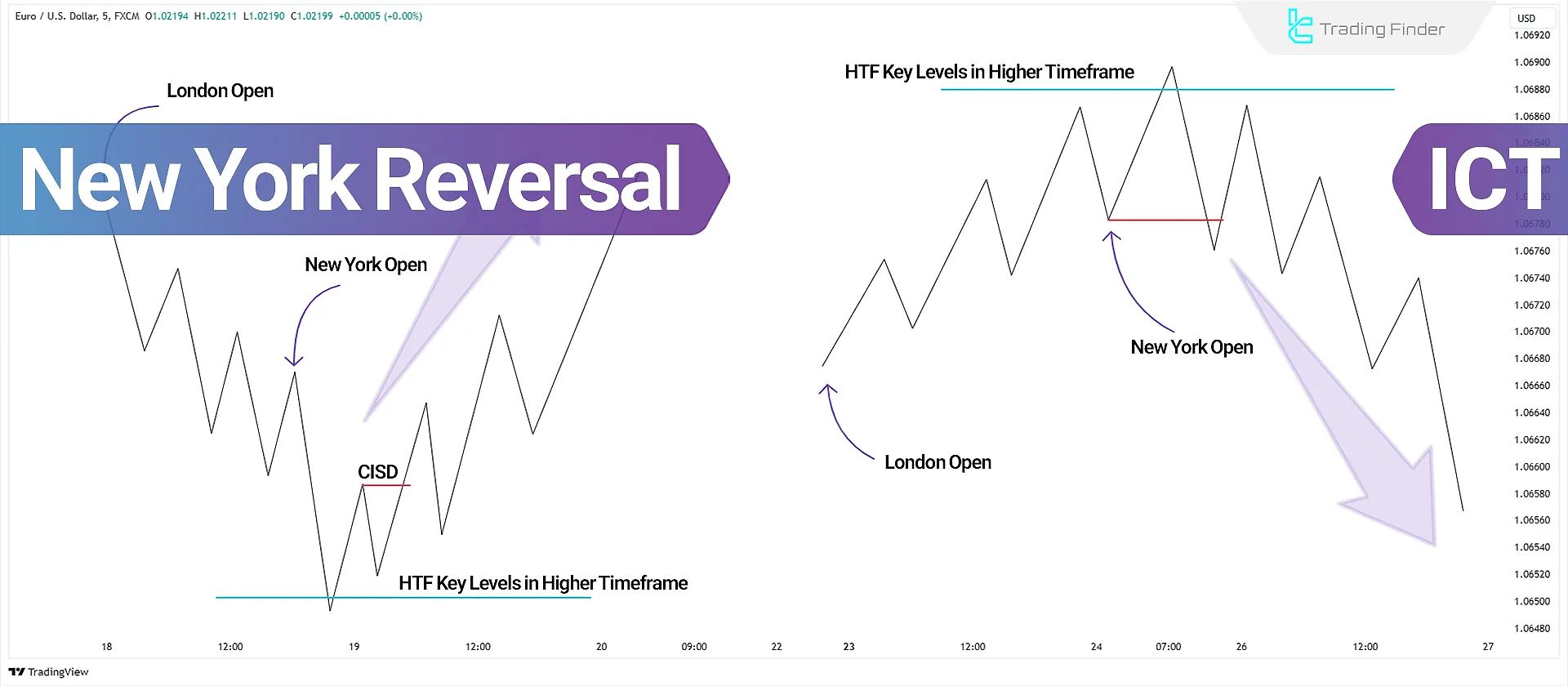

Understanding trade reversal is crucial for any trader looking to capitalize on market movements. A trade reversal occurs when the price direction of an asset changes from an upward trend to a downward trend, or vice versa. Recognizing the key indicators of a potential trade reversal can be beneficial. Some of the primary indicators include moving averages, relative strength index (RSI), and support and resistance levels. For instance, if the RSI indicates overbought conditions while the price reaches a resistance level, a reversal might be imminent.

In addition to identifying indicators, employing effective strategies can help traders successfully navigate trade reversals. One widely used approach is to utilize candlestick patterns to spot potential reversals early. Patterns such as the hammer, shooting star, or engulfing patterns can provide visual cues for traders. Furthermore, implementing a well-defined risk management strategy is essential; traders should consider setting stop-loss and take-profit orders to mitigate potential losses during reversal periods. By combining these indicators and strategies, traders can enhance their chances of making informed decisions and maximizing profit opportunities.

Counter-Strike is a highly popular first-person shooter game that emphasizes teamwork and strategy. Players engage in a variety of missions, ranging from hostage rescue to bomb defusal. For those interested in the trading aspect of the game, you can learn how to reverse trade cs2 to enhance your gaming experience.

What Triggers a Trade Reversal in CS2?

In the competitive landscape of CS2, a trade reversal can be triggered by several key factors. First and foremost, market psychology plays a crucial role; if players believe that the price has reached a peak or a valley, they may begin to counteract the prevailing trend. Additionally, major updates or changes in the game mechanics can alter player behavior significantly, leading to sudden shifts in trading patterns. Elements such as new skins, weapon balances, or changes in the maps can create a ripple effect, prompting traders to reassess their strategies.

Another significant factor contributing to trade reversals in CS2 is the influence of technical analysis. Traders often utilize indicators and chart patterns to forecast future movements based on historical data. When a key support or resistance level is breached, it can signal an imminent reversal. For instance, if a popular skin consistently holds a price point but suddenly dips below that threshold, traders will often interpret this as a sign to either buy in anticipation of a rebound or to sell off their assets before prices drop further. Ultimately, understanding these triggers can empower players to make more informed trading decisions.

Steps to Identify and Manage Trade Reversals Effectively

Identifying trade reversals is crucial for traders looking to maximize their profits and minimize losses. The first step in recognizing a potential reversal is to analyze price patterns and volume trends. Look for key indicators such as support and resistance levels, as they often signal when a market is ready to reverse. Additionally, consider using technical indicators like the Relative Strength Index (RSI) and moving averages to provide further confirmation of a reversal. By combining these analytical tools, you can enhance your ability to spot price shifts and react accordingly.

Once a trade reversal has been identified, effective management of the position becomes essential. Implementing a solid risk management strategy is vital to protect your capital. Start by setting stop-loss orders to limit potential losses in case the market moves against your position. It's equally important to establish clear profit targets based on market data and analysis. Regularly reviewing your trades and making adjustments as necessary will ensure that you stay responsive to market changes. By following these steps, you can manage trade reversals effectively and increase your trading success.