C155C Chronicles

Exploring the latest trends and insights.

Virtual Currency Trends: The Game Changer in Digital Finance

Discover how virtual currency trends are revolutionizing digital finance and shaping the future of money. Don’t miss these game-changing insights!

Understanding Virtual Currency: How Trends are Shaping the Future of Digital Finance

As the world shifts increasingly towards a digital economy, virtual currency continues to gain traction in various sectors. From Bitcoin to Ethereum, the rise of cryptocurrencies has been nothing short of revolutionary. This phenomenon is not just limited to speculative investments; it is reshaping how individuals and businesses transact. The adoption of blockchain technology, which underpins many of these currencies, offers greater transparency and security, making it an attractive option for those wary of traditional financial systems.

The ongoing trends in digital finance indicate a broader acceptance of virtual currencies, fueled by factors such as increased regulatory clarity and mainstream investments. For example, financial institutions are beginning to explore the integration of blockchain in their operations, while large corporations are accepting cryptocurrency as a payment method. This growing acceptance is catalyzing a shift in consumer behavior, prompting more people to consider virtual currencies as a viable alternative to fiat currency. Ultimately, understanding these trends is crucial for anyone looking to navigate the future landscape of finance.

Counter-Strike is a popular first-person shooter that has become a staple in competitive gaming. Players can engage in intense matches, showcasing their skills and strategies. For those looking to enhance their gaming experience, a csgoroll promo code can provide some exciting benefits.

The Impact of Blockchain Technology on Virtual Currency Trends

The advent of blockchain technology has significantly transformed the landscape of virtual currencies, introducing unparalleled levels of transparency and security. Unlike traditional banking systems, which can be prone to errors and fraud, blockchain offers a decentralized ledger that records transactions across a network of computers. This innovative approach not only enhances trust among users but also encourages greater participation in the realm of virtual currencies. As a result, we have witnessed a surge in the adoption and diversification of digital assets, making the market more accessible to the average consumer.

Moreover, the integration of blockchain technology in virtual currencies has paved the way for novel financial instruments, such as smart contracts and decentralized finance (DeFi) platforms. These developments allow for automated, self-executing contracts that eliminate the need for intermediaries, thereby reducing costs and increasing efficiency. As we look to the future, the impact of blockchain on virtual currency trends is expected to grow, with potential implications for regulatory frameworks and overall market dynamics. Enthusiasts and investors alike are keeping a close eye on these trends, recognizing the remarkable potential that lies ahead.

Is Virtual Currency the Future of Money? Exploring Current Trends and Future Predictions

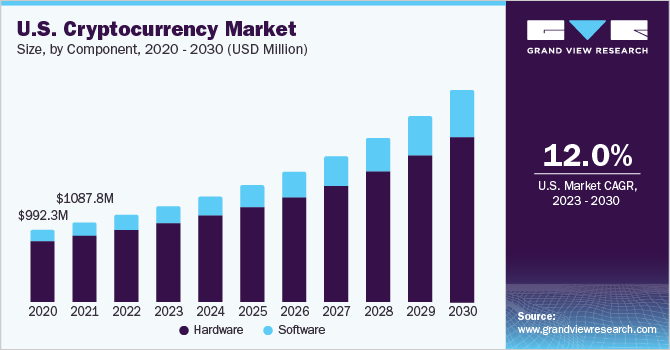

The rise of virtual currency has sparked a revolution in the financial landscape. As more individuals and businesses embrace digital transactions, the question arises: Is virtual currency the future of money? Current trends indicate a significant increase in the adoption of cryptocurrencies such as Bitcoin, Ethereum, and stablecoins. According to recent reports, over 300 million people worldwide now use cryptocurrency, and this number is expected to grow. The advantages of virtual currencies, including lower transaction fees, faster remittance services, and enhanced security via blockchain technology, support the idea that digital currencies may redefine financial exchanges.

Looking ahead, several predictions suggest that virtual currency could become mainstream in the next decade. Financial experts believe that major corporations will eventually accept digital currencies as a viable form of payment, leading to greater integration into everyday transactions. Moreover, government-backed digital currencies, or central bank digital currencies (CBDCs), are already being explored by various nations, further legitimizing the role of virtual currencies in the economy. As technology evolves and regulatory frameworks adapt, the future of money may very well include a world where virtual currencies coexist with traditional fiat money.